Where to Find Adjusted Gross Income on My Tax Returns?

Reviewing Your Adjusted Gross Income (AGI)

The adjusted gross income, also known as AGI, is an important number looked at when obtaining a mortgage. If you work for an organization and are a W2 employee, you may not need the tax returns. However, if you are self-employed or have various forms of income, then your tax returns may be requested.

Underwriters will typically not consider the gross income, but instead of focus on the net income. The adjusted gross income gives an idea of the taxable income you had on the recent tax returns. From a high level perspective, it takes your income from the year, and then factors in deductions which are allowable by the U.S. government.

Below is a breakdown to show more detail to help you understand:

Gross Income

This includes all the money you earn from various sources, such as:

-Wages and salary

-Interest and dividends

-Rental income

-Business income

-Retirement income (e.g., Social Security, pensions)

-Alimony (for divorce agreements before 2019)

-Capital gains

Adjustments to Income

Next, you can subtract certain adjustments to your income to calculate your adjusted gross income. These adjustments are typically available regardless of whether you itemize deductions. Some common adjustments include:

-Contributions to traditional IRAs or 401(k) plans

-Student loan interest (up to a certain limit)

-Tuition and fees deductions

-Health Savings Account (HSA) contributions

-Alimony payments (for divorce agreements finalized before 2019)

-Self-employed health insurance premiums

These adjustments help reduce your gross income to arrive at your AGI.

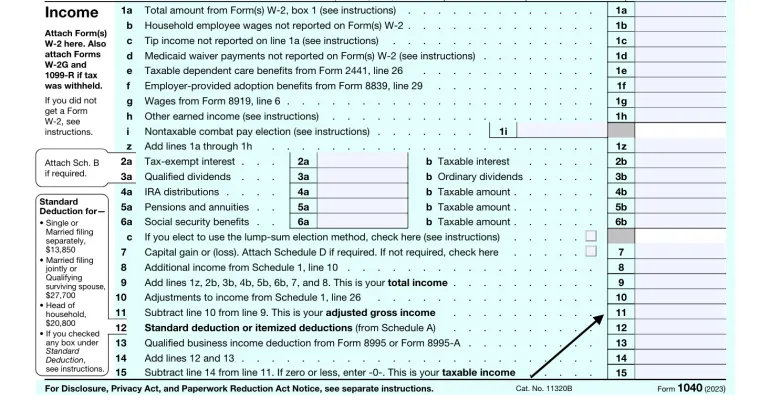

How to Find Your Adjusted Gross Income

On your IRS Form 1040, the adjusted gross income will be on line 11. It will show the total income reported on the tax returns along with eligible adjustments listed above.

As an example, if your income was $95,000 and you qualified for $5000 in adjustments, your AGI would be lower than the gross income. Perhaps, you had a contribution to your IRA account as an example, the AGI would be $90,000.

Business Owners

Many times a business owner will advise they earned a certain amount. That could be a large amount, but underwriting for a mortgage will look at the net income rather than the gross income. Here's an example. A business generated $500,000 in gross annual income. After factoring in rent for the location, employee payroll, marketing, supplies and transportation costs, the business had $400,000 in expenses. That would leave $100,000 as the net income. This will often flow to the owner's personal tax returns depending on how the corporation was set up. For example, a K1 may be issued showing the net income. Now, the $100,000 will be on the personal tax returns as the net income, but there could be additional expenses counted on the personal returns. After these deductions, if any, are factored in, the adjusted gross income will be calculated.

It's important to have a general idea of this because the underwriter will be looking at these numbers to determine your income.

Ready to buy a home?

Before shopping for homes, you should obtain a pre-approval letter.

Know how much you can qualify for.

Send your items in beforehand to be reviewed.

Review funds you may need to purchase a home.

Allow a smoother process from the beginning.

Your mortgage journey.

Various loan type options including:

Credit Tips

Check Your Credit Reports

Pay Your Bills on Time

Reduce Debt

Don't Open New Accounts

Keep Older Accounts

Diversify Your Credit

Be Responsible

Credit Score Knowledge

Managing your credit properly and monitoring your credit score in preparation for obtaining a home loan is a smart idea, and considered an essential step toward achieving homeownership. The credit score plays an important role in determining your eligibility for a mortgage and the interest rates you may receive. Whether you’re a first-time homebuyer or looking to refinance, investing time in improving your credit can lead to significant long-term savings and opportunities. Start today, and you'll be one step closer to your dream home.

Purchase

Get pre-approved to purchase your first home, second home or upcoming investment property.

Refinance

Own a property and interested in lowering your payment? Need to take cash out? Refinance with confidence.

Connect with Us

Our experienced team with be happy to speak with you, and walk you through each step of the process.

Providing mortgage solutions to help you with your home.

Mortgages can be complicated and have many moving parts. Let our team help you!

Contact Us

It only takes a few moments to reach out and have an initial conversation.

Know the Next Steps

Our team will work with you to find the best way to achieve your home loan goals.

Find Your Home and Get Your Loan

Our team will be prepared to move with the next steps once you have secured your home purchase contract.

Houses

Townhomes

Condos

Multi-Units

How much home can I afford?

Which home loan program is right for me?

Contact our team today.

1-800-583-5305

© Copyright 2024 E Mortgage Capital, Inc.. All rights reserved.

- 1416824 | E Mortgage Capital, Inc.

Notice To Texas Loan Applicants: Consumers wishing to file a complaint against a mortgage banker, or a licensed mortgage banker residential mortgage loan originator, should complete and send a complaint form to the Texas Department of Savings and Mortgage Lending, 2601 North Lamar, Suite 201, Austin, TX 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov

A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed mortgage banker residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at

www.sml.texas.gov